Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

CBO Director Warns US Fiscal Path Is 'Not Sustainable' ; Projects Additional $1.4T Deficit Swell Under Trump Agenda

CBO Director Warns US Fiscal Path Is 'Not Sustainable' ; Projects Additional $1.4T Deficit Swell Under Trump Agenda | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

The Congressional Budget Office raised its 10-year deficit estimate by $1.4 trillion, citing Trump's 2025 reconciliation act, higher tariffs and lower immigration.

- Annual deficits are projected to remain historically large, totaling $23.1 trillion from 2026 to 2035 and reaching 6.7% of GDP by 2036.

- The 2025 tax law is the single largest driver, adding $4.7 trillion to deficits over the decade, partially offset by roughly $3 trillion in tariff revenue.

- Federal debt held by the public is projected to rise to 120% of GDP by 2036, surpassing the post-World War II record by 2030.

- Interest costs are expected to double over the next decade, climbing from $1 trillion in 2026 to $2.1 trillion in 2036 as debt and rates rise.

- Economic growth is projected to strengthen in 2026 but slow to 1.8% thereafter, falling short of the administration’s 3% growth target despite productivity gains from artificial intelligence.

mat200

IPCT Contributor

- Jan 17, 2017

- 17,824

- 30,019

This is the single biggest economic issue IMHO.

We were able to retire comfortably primarily due to paying down debt in our 50s. Combined with selling our house and downsizing to the Swamp mortgage free

Being free of all debt going into retirement allows you to live inexpensively and gives peace of mind and opens up possibilities. We live month to month on SS not because we have to, but because we CAN.

The nest egg continues to grow with conservative investments and we don’t need to touch it. We don’t need it to make %12-%15 per year because we don’t rely on it to pay the monthly bills and don’t need to take on the risk. Having lived through 2000 and 2008/2009 crashes and watching 30%+ losses I’m risk averse.

The plan was to have enough nest egg to maintain quality of life to age 90 even if SS goes away (assuming %3 increases in income and COL). Investments in fixed income 4-5% bring in 80% of our current monthly expenses. So it continues to grow

If I wanted to buy a pontoon boat or new car (sub $100k) I could. It would take 2 years to pay it off with the interest from investments. Or if we decided to gift to 4 kids each year we can do same with a reduced growth, still not touching the nest egg. Cushion is a nice feeling. We don’t worry about eating out or using Instacart for groceries, or that our “misc” line item is the biggest number in the monthly budget.

I say all of this to recommend to those in their 20s, 30s, 40,s that debt is necessary for most of us at that age, I get it. Just don’t forget to have a plan to pay it off before you retire.

We were able to retire comfortably primarily due to paying down debt in our 50s. Combined with selling our house and downsizing to the Swamp mortgage free

Being free of all debt going into retirement allows you to live inexpensively and gives peace of mind and opens up possibilities. We live month to month on SS not because we have to, but because we CAN.

The nest egg continues to grow with conservative investments and we don’t need to touch it. We don’t need it to make %12-%15 per year because we don’t rely on it to pay the monthly bills and don’t need to take on the risk. Having lived through 2000 and 2008/2009 crashes and watching 30%+ losses I’m risk averse.

The plan was to have enough nest egg to maintain quality of life to age 90 even if SS goes away (assuming %3 increases in income and COL). Investments in fixed income 4-5% bring in 80% of our current monthly expenses. So it continues to grow

If I wanted to buy a pontoon boat or new car (sub $100k) I could. It would take 2 years to pay it off with the interest from investments. Or if we decided to gift to 4 kids each year we can do same with a reduced growth, still not touching the nest egg. Cushion is a nice feeling. We don’t worry about eating out or using Instacart for groceries, or that our “misc” line item is the biggest number in the monthly budget.

I say all of this to recommend to those in their 20s, 30s, 40,s that debt is necessary for most of us at that age, I get it. Just don’t forget to have a plan to pay it off before you retire.

This is the more immediate problem, and don’t fantasize that it’s because of AI. That will eventually feed the fire, but it’s not the current problem.

The economy has and is slowing at a fast pace.

The economy has and is slowing at a fast pace.

Market went from green to ugly in about 10 minutes.

I lost a chunk, but still up +2.8% YTD

S&P -0.66 (Thats MINUS -0.66% YTD. as of 2/12)

This triggered it. Just no good news to be found and everyone is waiting on the big crash

www.zerohedge.com

www.zerohedge.com

I lost a chunk, but still up +2.8% YTD

S&P -0.66 (Thats MINUS -0.66% YTD. as of 2/12)

This triggered it. Just no good news to be found and everyone is waiting on the big crash

US Existing Home Sales Collapsed In January

US Existing Home Sales Collapsed In January | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Last edited:

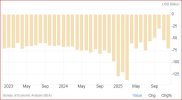

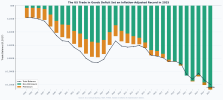

US Trade Deficit Unexpectedly Worsens As Exports Slump Again In December

US Trade Deficit Unexpectedly Worsens As Exports Slump Again In December | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Ummmm....pulling numbers out of his ass has become the shining star of the Epstein Administration

Last edited:

Arjun

IPCT Contributor

tigerwillow1

Known around here

US Trade Deficit Unexpectedly Worsens As Exports Slump Again In December

US Trade Deficit Unexpectedly Worsens As Exports Slump Again In December | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Ummmm....pulling numbers out of his ass has become the shining star of the Epstein Administration

View attachment 238429

As is typical, the stats and headlines can also be warped in the opposite direction.

"The U.S. trade deficit narrowed sharply in the fourth quarter...................."

Trump Effect: Trade Deficit Narrows as Trump Tariffs Reshape Global Commerce

Presented for entertainment purposes only. The December numbers will probably get revised just as the November numbers were revised. One article cherry picks a single month, the other a 3-month period, both to justify the sensational looking headline they want. The Breitbart article does at least admit the full-year picture is different from the narrative the headline is selling, buried deep in the article of course. I'm once again in the not believing any of it camp.

Nice try. My personal fact checker

Wrong again

Trump, not someone else, Trump said this, which is blatantly false

There's no nuance, no complex story being told, no two ways to tell it.

Brietbart is a Trump cheerleader who ignores reality . The numbers don't care.

Per CNBC

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump’s tariffs

The 2025 trade deficit increased to $903.5 billion from $901.1 billion in 2024 per the Census Bureau /BEA

Wrong again

Trump, not someone else, Trump said this, which is blatantly false

There's no nuance, no complex story being told, no two ways to tell it.

Brietbart is a Trump cheerleader who ignores reality . The numbers don't care.

Per CNBC

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump’s tariffs

The 2025 trade deficit increased to $903.5 billion from $901.1 billion in 2024 per the Census Bureau /BEA

Last edited:

Arjun

IPCT Contributor

I had not viewed this thread in a while. Hmmmmm... Gold seems to have settled in around the $5k mark now. I have a question:

If the dollar is significantly devalued, does that make our national debt easier to retire? If bonds were sold years ago at a given interest rate to fund government, isn't it easier to pay off that debt now? Explain it to me like I'm 10.

If the dollar is significantly devalued, does that make our national debt easier to retire? If bonds were sold years ago at a given interest rate to fund government, isn't it easier to pay off that debt now? Explain it to me like I'm 10.

someone asked about debt and lowering interest rates and the devalued dollar.

There are many much smarter than me with PhD’s in economics that have a hard time explaining it so I’m not going to try.

Devaluing the dollar by definition is inflation. Cutting interest rates to near 0 will cause greater inflation

But until you cut spending it wont matter anyway

Then there's is this;

JUST IN: President Trump says interest rate cuts would reduce US debt.

Grok

Lower interest rates can reduce the U.S. government's borrowing costs on new or refinanced debt, potentially lowering interest payments (currently ~$1T/year). This could indirectly help reduce debt by freeing up funds for principal repayment or deficit cuts, if paired with fiscal discipline. However, it risks inflation and doesn't shrink principal alone—growth and policy matter.

There are many much smarter than me with PhD’s in economics that have a hard time explaining it so I’m not going to try.

Devaluing the dollar by definition is inflation. Cutting interest rates to near 0 will cause greater inflation

But until you cut spending it wont matter anyway

Then there's is this;

JUST IN: President Trump says interest rate cuts would reduce US debt.

Grok

Lower interest rates can reduce the U.S. government's borrowing costs on new or refinanced debt, potentially lowering interest payments (currently ~$1T/year). This could indirectly help reduce debt by freeing up funds for principal repayment or deficit cuts, if paired with fiscal discipline. However, it risks inflation and doesn't shrink principal alone—growth and policy matter.

Last edited:

If you want to deep dive this hs a good start.

I encourage reading the thread not just the headline post as many point out inconsistencies in the theory

Regardless, if you drop rates to near 0 and continue devaluing the dollar, inflation and asset prices will both go up.

And who will buy this 0% interest debt?

I encourage reading the thread not just the headline post as many point out inconsistencies in the theory

Regardless, if you drop rates to near 0 and continue devaluing the dollar, inflation and asset prices will both go up.

And who will buy this 0% interest debt?

tigerwillow1

Known around here

The U.S. trade deficit swelled in December, closing out a year in which the imbalance was essentially unchanged despite efforts by the Trump administration to close the wide gap.

www.cnbc.com

www.cnbc.com

U.S. trade deficit totaled $901 billion in 2025, barely budging despite Trump's tariffs

The U.S. trade deficit swelled in December, closing out a year in which the imbalance was essentially unchanged.