Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Click on 'See Details"

Im running two different AV systems and a firewall appliance with IPS and I'm not seeing it

You're likely seeing something like this

PR_CONNECT_RESET_ERROR

Its because the website itself isnt live. I have no idea the owner, but trust that X has way better security than you or I

Im running two different AV systems and a firewall appliance with IPS and I'm not seeing it

You're likely seeing something like this

PR_CONNECT_RESET_ERROR

Its because the website itself isnt live. I have no idea the owner, but trust that X has way better security than you or I

Last edited:

Yeah Weird, I saw this yesterday too, what is also weird is it only pops up on page 109 of this thread...so it must be something on that page, some preview site...not thinking an X post...Click on 'See Details"

Im running two different AV systems and a firewall appliance with IPS and I'm not seeing it

You're likely seeing something like this

PR_CONNECT_RESET_ERROR

Its because the website itself isnt live. I have no idea the owner, but trust that X has way better security than you or I

Buffet? Warren?

I know AVG has many issues, like other Antivirus programs.

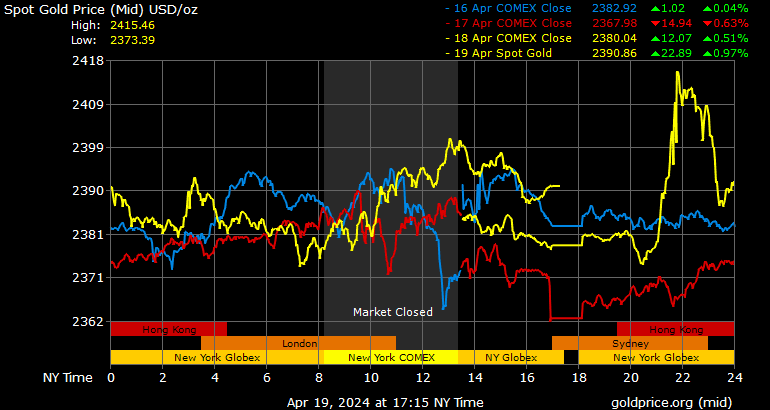

Gold took a nosedive today didn't it?

Gold took a nosedive today didn't it?

They’re taking it down hard.

Sold my #GLD ETF holdings yesterday after the big move at about 3:45. after taking a small beating the day before.

One of the few times I actually made a good call on selling!

Had held it for 5 weeks and have a nice roughly 20% profit.

Had intended to let it ride up to $5000 but I no longer have the stomach for wild daily swings. Back to a Schwab MM and boring VTHRX. At least my sleep will improve

Last edited:

mat200

IPCT Contributor

- Jan 17, 2017

- 17,776

- 29,945

Wow

Can you say bubble?

as a Real Estate Agent would have stated in 2007-2008 .. House prices only go up .. great time to buy ..

LOL we did in 2007! Sold in summer of ‘22 and came out very well. But watching the value go down 50% in 2009-2011 was sobering

tigerwillow1

Known around here

Except you copied the current bracket chart. The 2026 chart is further down on the page. I got caught by the same thing, the headline says "new" brackets then the first thing they show is the old/current brackets.The new tax brackets are out...

good catch man--- I added the 2026 chart to that reply-- interesting comparison.Except you copied the current bracket chart. The 2026 chart is further down on the page. I got caught by the same thing, the headline says "new" brackets then the first thing they show is the old/current brackets.

So I know I have brought this up before, probably a couple of times, but did not get the answer planted in my head. The wife and I filing jointly are in the 12% tax bracket. Our kids, well 2 out of 3 are in the 32% bracket.

We had a CD mature in the wife's IRA this month, we are thinking of pulling it out and paying the taxes on it, actually would like to do the same with all the money in the IRA over time. Why? If, big If, we only are taxed at 12-22%, we are thinking it is lower than what our kids would have to pay if/when they have to drain the IRA, unless they are retired when we pass. On my Dad's IRA I have 10 years to fully drain it...a spouse would not have to...

But I remember when I posted this same question awhile back someone's reply saying the amount taxed from an IRA is different than regular income tax...just can't find the post...we may need to consult an CPA...

What we are realizing, a traditional IRA, has the same investment opportunities as normal monies outside an IRA. If it were liquid, taxes paid, just thinking it would be better for the kids. But may be wrong...

We had a CD mature in the wife's IRA this month, we are thinking of pulling it out and paying the taxes on it, actually would like to do the same with all the money in the IRA over time. Why? If, big If, we only are taxed at 12-22%, we are thinking it is lower than what our kids would have to pay if/when they have to drain the IRA, unless they are retired when we pass. On my Dad's IRA I have 10 years to fully drain it...a spouse would not have to...

But I remember when I posted this same question awhile back someone's reply saying the amount taxed from an IRA is different than regular income tax...just can't find the post...we may need to consult an CPA...

What we are realizing, a traditional IRA, has the same investment opportunities as normal monies outside an IRA. If it were liquid, taxes paid, just thinking it would be better for the kids. But may be wrong...

I'm not a tax advisor or financial consultant. I eat crayons

That said

1- With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal

2- What I'm doing is pulling as much as I can out of my 401K (same difference) each year and doing it as a rollover to a Roth IRA we established 10 years ago (we each have one). So a rollover but spread out over likely 7 years.

Same as you we are trying to stay in the 12% bracket.

So you have income consisting of: SS, Dividends and Interest, and now this 401K/IRA money, that all adds up to your gross income

We know that married filing jointly we need AGI to come in less than $96,950 this year (ALL income minus 31,500 std ded, 1600 for being over 65, and the new $6000 deduction- so $39,100 Deductions)

The Roth is the best way to do this IMHO as you have ALL investment choices and ALL gains are tax free forever, and no RMD's

The tax I pay on that rollover portion is just part of my total 2025 AGI and I'm taking just enough to stay under the $96,950 after deductions

I'd ask about a Roth Rollover (you dont take possession of the $ it is made out to your Roth broker, otherwise its treated as a simple withdrawl as you indicate)

You should be able to roll the entire IRA into a New Roth (still gotta pay tax on the rollover that year), but from there on out you control it and no taxes on any gains

*Only caveat is the Roth must exist for 5 years before withdrawing earnings/gains

If you can't do a Roth then taking it out is simply a question of your tax liability tolerance for the year you withdraw it as it all counts as income for that year

From Investopedia

A Roth IRA switches the situation. It doesn't offer an upfront tax deduction like a traditional IRA, but qualified withdrawals from a Roth IRA are tax-free in retirement. 2 If you inherit a Roth IRA, withdrawals of contributions are tax-free at any time. And You can withdraw earnings free from tax and penalty if at least five years have passed since the beginning of the tax year when the original account owner made the first contribution, even if the new owner is 59½ or older.

That said

1- With a traditional IRA, withdrawals are taxed as regular income (not capital gains) based on your tax bracket in the year of the withdrawal

2- What I'm doing is pulling as much as I can out of my 401K (same difference) each year and doing it as a rollover to a Roth IRA we established 10 years ago (we each have one). So a rollover but spread out over likely 7 years.

Same as you we are trying to stay in the 12% bracket.

So you have income consisting of: SS, Dividends and Interest, and now this 401K/IRA money, that all adds up to your gross income

We know that married filing jointly we need AGI to come in less than $96,950 this year (ALL income minus 31,500 std ded, 1600 for being over 65, and the new $6000 deduction- so $39,100 Deductions)

The Roth is the best way to do this IMHO as you have ALL investment choices and ALL gains are tax free forever, and no RMD's

The tax I pay on that rollover portion is just part of my total 2025 AGI and I'm taking just enough to stay under the $96,950 after deductions

I'd ask about a Roth Rollover (you dont take possession of the $ it is made out to your Roth broker, otherwise its treated as a simple withdrawl as you indicate)

You should be able to roll the entire IRA into a New Roth (still gotta pay tax on the rollover that year), but from there on out you control it and no taxes on any gains

*Only caveat is the Roth must exist for 5 years before withdrawing earnings/gains

If you can't do a Roth then taking it out is simply a question of your tax liability tolerance for the year you withdraw it as it all counts as income for that year

From Investopedia

A Roth IRA switches the situation. It doesn't offer an upfront tax deduction like a traditional IRA, but qualified withdrawals from a Roth IRA are tax-free in retirement. 2 If you inherit a Roth IRA, withdrawals of contributions are tax-free at any time. And You can withdraw earnings free from tax and penalty if at least five years have passed since the beginning of the tax year when the original account owner made the first contribution, even if the new owner is 59½ or older.

Last edited:

tigerwillow1

Known around here

Money withdrawn from a traditional IRA is taxed as ordinary income, regardless of what it might be (capital gain, for instance). The thing to watch out for, if getting social security and under the maximum social security taxation of 85%, AND in the 12% marginal tax bracket, is whatever you withdraw will increase the social security taxation rate, with the net effect being 22% federal tax on what you withdraw.

Money withdrawn from a traditional IRA is taxed as ordinary income, regardless of what it might be (capital gain, for instance). The thing to watch out for, if getting social security and under the maximum social security taxation of 85%, AND in the 12% marginal tax bracket, is whatever you withdraw will increase the social security taxation rate, with the net effect being 22% federal tax on what you withdraw.

I;m not gettting that about SS?

Lets say combined SS 60

Lets say Divs and Interest (non deferred, taxable) 25

Lets say IRA/401K rollover 45

So total 130 income

Std Deductions of 39.100

So taxable = 90,900

12% bracket is $96950

(I thought in that scenario SS would be taxed at my 12% rate, yes 85% of it, which would actually lower the above equation but didnt want to complicate it)

Last edited:

The key is "and under the maximum social security taxation of 85%" in Tigers post. If you're already at the 85% then you are correct, it makes no difference.