When the largest bank in the US ( equal to the combined total of the next 3 biggest) and one of the top 3 in the world says pump the brakes, seems to me you should locate your brake peddle and be prepared to apply it

The takeaway for investors is diversifying their portfolios in case America’s debt begins to spiral more quickly than the current environment, Kelly said: “There is a danger that political choices lead to a faster deterioration in the federal finances, leading to a backup in long-term interest rates and a lower dollar. Based on current allocations and valuations alone, many investors should likely consider diversifying their portfolios by adding alternative assets and international stocks. The risk that we move from going broke slowly to going broke quickly adds an important reason to make this move today.”

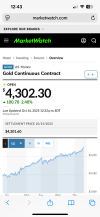

- J.P. Morgan’s David Kelly warned this week that while America is “going broke” it’s doing so slowly enough that markets aren’t panicking yet. With U.S. national debt now topping $37.8 trillion and interest payments exceeding $1.2 trillion, Kelly said the debt-to-GDP ratio—already at 99.9%—will likely keep rising even under moderate growth. Despite tariff revenues and temporary deficit relief, he cautioned that political choices or a slowdown could quickly worsen the fiscal picture, urging investors to diversify away from U.S. assets before “going broke slowly” turns fast.

The takeaway for investors is diversifying their portfolios in case America’s debt begins to spiral more quickly than the current environment, Kelly said: “There is a danger that political choices lead to a faster deterioration in the federal finances, leading to a backup in long-term interest rates and a lower dollar. Based on current allocations and valuations alone, many investors should likely consider diversifying their portfolios by adding alternative assets and international stocks. The risk that we move from going broke slowly to going broke quickly adds an important reason to make this move today.”

Last edited: