Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

^^^^

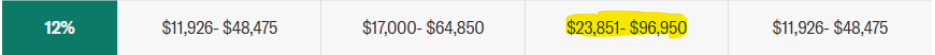

THIS IS ACTUALLY WHAT I NEEDED GUYS. THANK YOU!!! It was the SS that I did not plant in my head, well and the IRA is taxed at income level. Pretty sure we are being taxed at the 85% on our SS, Combined/Jointly...now if they are individually taxed then both of us are at the 50% SS tax bracket...but we do file Jointly...

THIS IS ACTUALLY WHAT I NEEDED GUYS. THANK YOU!!! It was the SS that I did not plant in my head, well and the IRA is taxed at income level. Pretty sure we are being taxed at the 85% on our SS, Combined/Jointly...now if they are individually taxed then both of us are at the 50% SS tax bracket...but we do file Jointly...

So this may now make some sense to me since in TurboTax I see a lower Effective Tax Rate than 12% unless I don't understand what that means...I;m not gettting that about SS?

Lets say combined SS 60

Lets say Divs and Interest (non deferred, taxable) 25

Lets say IRA/401K rollover 45

So total 130 income

Std Deductions of 39.100

So taxable = 90,900

12% bracket is $96950

(I thought in that scenario SS would be taxed at my 12% rate, yes 85% of it, which would actually lower the above equation but didnt want to complicate it)

Oh I see, this is an average rate for the year...

Effective Tax Rate Confusion

So, from previous posts, it seem TT"s "Effective Tax Rate" is meaningless. Unfortunate. So, what is it that I look at to determine the tax bracket I'm in. I see brackets that say for 2024, Single 11K-47K is 12% 47K-100K is 22%. 100-191K is 24% So which line item in TT do I look at to...

tigerwillow1

Known around here

There are many interactions in the tax code that can lead you to bad decisions. Deduction phaseouts are another example in addition to the pretty well hidden social security taxation rate. Oregon income tax is horrible with these:

Credit for contribution to a 529 plan begins to phase out at AGI 30k (All #s for joint returns)

A senior medical subtraction begins to phase out at $50k AGI.

Personal exemption credit disappears at AGI $200k.

Credit for federal tax paid begins to phase out at AGI $250k

None of these thresholds are indexed.

Then at the federal level, if you're on Medicare, there's IRMAA. If you have a good year with AGI in the $200k ballpark or above, you'll get socked with a big increase in the Medicare premium. This one is indexed, but the amount of the threshold isn't announced until a year or two after the tax year ends, so even if you're able to control your AGI (like with IRA withdrawals or Roth conversions), you don't know the AGI to stay under until after the year ends and it's too late.

Credit for contribution to a 529 plan begins to phase out at AGI 30k (All #s for joint returns)

A senior medical subtraction begins to phase out at $50k AGI.

Personal exemption credit disappears at AGI $200k.

Credit for federal tax paid begins to phase out at AGI $250k

None of these thresholds are indexed.

Then at the federal level, if you're on Medicare, there's IRMAA. If you have a good year with AGI in the $200k ballpark or above, you'll get socked with a big increase in the Medicare premium. This one is indexed, but the amount of the threshold isn't announced until a year or two after the tax year ends, so even if you're able to control your AGI (like with IRA withdrawals or Roth conversions), you don't know the AGI to stay under until after the year ends and it's too late.

Good info @tigerwillow1 appreciate your help and expertise as well as @anijet

I knew about IRMAA but hadn’t really dug very deep into it. In future years RMDs are going to potentially become problematic to us so I need to crunch some numbers on that. That could be a big one!

Another one is SS limits on how much you can make before bumping into a problem. Mrs bigredfish is working part time hourly (for her former employer) from home and recently hit her magic number (about $22K iirc) so no more work for her until the new year.

I just recently discovered that this is temporary in that if you exceed the wage number, while they deduct $1 for every $2 over the limit from your SS payout, (under FRA) they credit it back to you once you hit FRA

I knew about IRMAA but hadn’t really dug very deep into it. In future years RMDs are going to potentially become problematic to us so I need to crunch some numbers on that. That could be a big one!

Another one is SS limits on how much you can make before bumping into a problem. Mrs bigredfish is working part time hourly (for her former employer) from home and recently hit her magic number (about $22K iirc) so no more work for her until the new year.

I just recently discovered that this is temporary in that if you exceed the wage number, while they deduct $1 for every $2 over the limit from your SS payout, (under FRA) they credit it back to you once you hit FRA

IRMAA, yes this hit us one year. The year both of my parents passed, 2020, the inheritance shot up our income quite a bit, over the 170k threshold back then which put my wife (Being on Medicare) in the next bracket paying around $70-80 more a month for combined Part B & D.There are many interactions in the tax code that can lead you to bad decisions. Deduction phaseouts are another example in addition to the pretty well hidden social security taxation rate. Oregon income tax is horrible with these:

Credit for contribution to a 529 plan begins to phase out at AGI 30k (All #s for joint returns)

A senior medical subtraction begins to phase out at $50k AGI.

Personal exemption credit disappears at AGI $200k.

Credit for federal tax paid begins to phase out at AGI $250k

None of these thresholds are indexed.

Then at the federal level, if you're on Medicare, there's IRMAA. If you have a good year with AGI in the $200k ballpark or above, you'll get socked with a big increase in the Medicare premium. This one is indexed, but the amount of the threshold isn't announced until a year or two after the tax year ends, so even if you're able to control your AGI (like with IRA withdrawals or Roth conversions), you don't know the AGI to stay under until after the year ends and it's too late.

How it works is they go back Two Years on your Income tax returns to calculate. This happened to us in 2022.

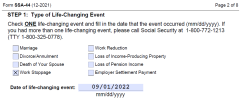

We were able to contest it by filing the below form which we took to a SS office, can't remember why, we spoke to several SS people and I think they all said it was best.

2025 Tax Year Form SSA-44 (12-2024) for (MAGI from 2023):

Anyway, we did finally get our money back. It was for the last 4 months of the 2022 year, my wife retired that year (Started SS) and we were able to use the hardship of no longer working...

Since she started her SS that year, the form had us calculate/estimate what our income (AGI) would be the following year (STEP 3), this got us a bit nervous since SS was new to us, but it must of worked since we never heard back from them.

This whole ordeal was a Life-Changing Event for us, LOL My wife was freaking out, mad at me for her possibly having to pay more a month on her Medicare, mad at me for not knowing, mad at me for our Net worth increasing, WHAT? Haha, just all around mad at me, so glad it worked out...

So IRMAA, I now know what this is

CORRECTION: DaWife (QUEEN)

just reminded/informed me we did not get any money back, they just changed it before the following year 2023. Since she was still working up until 09/01/2022, we still had her Work Health Insurance and even though she did have to sign up for Medicare at 65 two years prior, I think this is automatically done to everyone when you turn 65, it was only Part A for her so she was not having to pay for Part B or D yet.

just reminded/informed me we did not get any money back, they just changed it before the following year 2023. Since she was still working up until 09/01/2022, we still had her Work Health Insurance and even though she did have to sign up for Medicare at 65 two years prior, I think this is automatically done to everyone when you turn 65, it was only Part A for her so she was not having to pay for Part B or D yet.

Last edited:

Yeah, forgot to mention RMDs, what is happening to me is I have to take out a yearly RMD from my Dad's IRA since he was already taking it out and I have 10 years to completely deplete the IRA, so I am breaking it up in those 10 years to keep us at the lower income tax bracket. This 10 year thing is only for non-spouses...Good info @tigerwillow1 appreciate your help and expertise as well as @anijet

I knew about IRMAA but hadn’t really dug very deep into it. In future years RMDs are going to potentially become problematic to us so I need to crunch some numbers on that. That could be a big one!

Another one is SS limits on how much you can make before bumping into a problem. Mrs bigredfish is working part time hourly (for her former employer) from home and recently hit her magic number (about $22K iirc) so no more work for her until the new year.

I just recently discovered that this is temporary in that if you exceed the wage number, while they deduct $1 for every $2 over the limit from your SS payout, (under FRA) they credit it back to you once you hit FRA

Money & Economics

Haha, Arjun, I was posting and your message popped up, almost had a heart attack thinking I hit the wrong button, lol

So, one more question for all so I get this planted in my head.

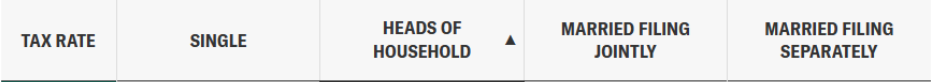

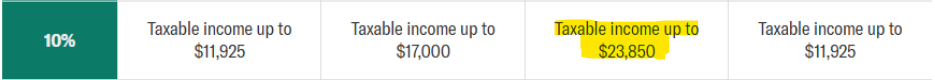

For 2025 Married Filing Jointly, we pay 10% for income up to $23,850k, then 12% for income between $23,851-$96,950, and 22% for the income over $96,951

Correct?

View attachment 230798

View attachment 230800

View attachment 230802

I think that’s right. AGI after deductions

So having to pay 22% on the last $10-20k would not be bad, thinking we take $50k out for this year, then, Jan. take another $50k, reason is $100k is needed to get a better return on the Money Market account our Broker offers...it is not a whole lot different but a years worth would make it worth it, in our opinion...I think that’s right. AGI after deductions

We have our yearly meeting with our Broker coming up, will ask about the ROTH too...

Thanks for your help...

So have been noticing this now on my phone. Since Mike fixed the Cloudfare issue or what ever the issues were that now allow me to see Previews on the Forum, I am now getting new content from Google as if I clicked on the post from @Arjun ...the girl at top left I saw Arjun posting, thinking in the Funny/Satire Thread...Think I found it:

@sdkid

View attachment 230692

Every time I scroll past this post I get it.

Wow, got me thinking, I have Previews turned Off in Outlook for emails to stop Malware, maybe having Previews On here on this Forum is not a good idea?

I guess previewing is like opening according to Google...

I know when I go to my History on Google it shows alot things I did not open or watch, just scrolling thru their list of videos and I guess hesitating enough for the video to start the first few seconds constitute a watch/history on Google. Which sucks because the wife will be questioning all of this explicit youth content showing up on YT, lol, dang another reason for her to be mad at me, LMAO

And I have been trying to avoid opening Arjun's post, haha, can't win...

My Apologies To Everybody In Advance #NotATrollSo have been noticing this now on my phone. Since Mike fixed the Cloudfare issue or what ever the issues were that now allow me to see Previews on the Forum, I am now getting new content from Google as if I clicked on the post from @Arjun ...the girl at top left I saw Arjun posting, thinking in the Funny/Satire Thread...

I guess previewing is like opening according to Google...

View attachment 230804

I know when I go to my History on Google it shows alot things I did not open or watch, just scrolling thru their list of videos and I guess hesitating enough for the video to start the first few seconds constitute a watch/history on Google. Which sucks because the wife will be questioning all of this explicit youth content showing up on YT, lol, dang another reason for her to be mad at me, LMAO

And I have been trying to avoid opening Arjun's post, haha, can't win...

As long as the wife/girlfriend/love companion does not find out, you are in safe handsHaha, Arjun, I was posting and your message popped up, almost had a heart attack thinking I hit the wrong button, lol

Last edited:

My Apologies To Everybody In Advance #NotATroll

No apologies needed, this is a Free country, well mostly free, you can post what you want. So thank you, now I am going to get Irish dancing videos on my phone, Hahahahaha

Keeps the momentum going...No apologies needed, this is a Free country, well mostly free, you can post what you want. So thank you, now I am going to get Irish dancing videos on my phone, Hahahahaha

tigerwillow1

Known around here

Back from dancers to taxes....

I spotted the RMD problem a bunch of years ago and realized the commonly spouted wisdom about how it's good to put money into a traditional IRA and take it out later in life when you're in a lower marginal bracket is often not very wise. My general thinking now is to get as much as possible out of the traditional IRA before you start drawing social security. I was able to only partially do that, and have since been playing the game of limiting roth conversions to stay in the 12% marginal bracket. What's really frustrating is that in my specific income mix there's almost a seamless transition from when the social security tax percentage hits 85%, and the marginal rate hits 22%. There's something like a $50 to $100 window where I can "escape" roth conversion $ at 12%, otherwise it's all at 22%, I would have been better off putting my working-days contributions straight into the roth.

Anyway, not my main point. Over a few years I've built up a spreadsheet that exactly mirrors the federal and state tax calculations, so I can brainstorm things and instantly see the tax result. I occasionally verify its accuracy with a tax program, which can also be used for the brainstorm, it's just a lot slower. Being an engineer type I believe everything can be represented in an equation, and have reverse-engineered a bunch of tax forms to an equation. I was not able to succeed with the social security taxation percentage. After wasting a lot of time trying I just programmed the tax form calculation into the spreadsheet one line at a time, 9 individual steps I couldn't figure out to to represent mathematically. It sometimes feels like these tax rules are generated by a bunch of monkeys throwing stuff at the wall.

This will be my last year of roth conversion. I'm leaving a residual amount in the traditional IRA to draw out as QCDs, giving a little satisfaction of getting some of it out with zero taxes.

I spotted the RMD problem a bunch of years ago and realized the commonly spouted wisdom about how it's good to put money into a traditional IRA and take it out later in life when you're in a lower marginal bracket is often not very wise. My general thinking now is to get as much as possible out of the traditional IRA before you start drawing social security. I was able to only partially do that, and have since been playing the game of limiting roth conversions to stay in the 12% marginal bracket. What's really frustrating is that in my specific income mix there's almost a seamless transition from when the social security tax percentage hits 85%, and the marginal rate hits 22%. There's something like a $50 to $100 window where I can "escape" roth conversion $ at 12%, otherwise it's all at 22%, I would have been better off putting my working-days contributions straight into the roth.

Anyway, not my main point. Over a few years I've built up a spreadsheet that exactly mirrors the federal and state tax calculations, so I can brainstorm things and instantly see the tax result. I occasionally verify its accuracy with a tax program, which can also be used for the brainstorm, it's just a lot slower. Being an engineer type I believe everything can be represented in an equation, and have reverse-engineered a bunch of tax forms to an equation. I was not able to succeed with the social security taxation percentage. After wasting a lot of time trying I just programmed the tax form calculation into the spreadsheet one line at a time, 9 individual steps I couldn't figure out to to represent mathematically. It sometimes feels like these tax rules are generated by a bunch of monkeys throwing stuff at the wall.

This will be my last year of roth conversion. I'm leaving a residual amount in the traditional IRA to draw out as QCDs, giving a little satisfaction of getting some of it out with zero taxes.