Amen, preach it brother...None of the current world financial institutions that are over extended with "paper money and/or paper gold/silver, should be a surprise!

All of these "data centers" are not for hashing Bitcoins or some other make believe digital money. One should even know, that inflation

will be so bad that a "loaf of bread for $20" will be the norm. The "data centers" you ask, they will be for the privilege to "buy or sell with the Mark"!

I even predict that it is going to get a whole lot worse for the rest that are left behind.

Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

1/23/2026 - Goldman Sachs 2026 year end Gold price target $5400 p/oz

Goldman Sachs quietly revamps gold price target for 2026

A change in investor behavior is driving the new callwww.thestreet.com

Today 1/28/2026

View attachment 237204

I chickened out at $5500

EMPIRETECANDY

IPCT Vendor

mat200

IPCT Contributor

- Jan 17, 2017

- 17,772

- 29,930

mat200

IPCT Contributor

- Jan 17, 2017

- 17,772

- 29,930

tigerwillow1

Known around here

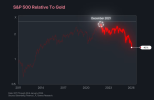

In the context of gold above $5,000 an ounce, when a 1 oz coin that you can easily hold in your hand is equivalent to 5,000 dollars, what does that say about the value of a dollar? Perhaps a more honest way to think about it is that a dollar is worth 1/5000 of an ounce of gold. For me, that says it's close to worthless.Relative to Gold, the US Stock market has dropped 45% since Dec 2021

In 2019:

Top 10 Most Valuable Currencies in the World - Treasury Vault

What is the most valuable currency in the world? Is it the British Pound, once the most valuable currency in world history? Issued in 775 A.D., it’s now about 1,200 years old. Or is it the world’s reserve currency, the United States dollar? In this Treasury Vault article, we’ve compiled a list...

treasuryvault.com

treasuryvault.com

Ok now im confused.

Think I’ll stay out of the housing market ..

Majority of people Don't own their homes, the Banks do. A Mortgage is like a lease-to-buy except if you walk away from a lease-to-buy you lose any equity you have.

I guess my point is, when I hear the word Own, in my mind, there are not that many who actually own their homes, maybe mobile homes? But have you seen the prices for those these days? $100k

What is going on.

It started yesterday.

Tuesday Gold was moving fast, I picked up some #GLD after having sold Friday.

(The #GLD ETF is about 10% the price of spot Gold, plus the ETF takes a tiny sliver.)

GLD | SPDR Gold Shares Overview | MarketWatch

GLD | A complete SPDR Gold Shares exchange traded fund overview by MarketWatch. View the latest ETF prices and news for better ETF investing.

So I grabbed some Tuesday just before close at $474 and held on Wednesday debating whether to sell as it was hovering about $480 most of the day, I was looking for it to start to dip and sell and instead right before close it went parabolic. Runaway train. I stared at it rising with my mouth open until about 7pm. When it it hit $512 (About $5525 Spot price?) I started for the Sell button assuming (correctly) that it would dump back down today. Prices were jumping back and forth in $5 increments in seconds for a while.

It took me a whole 30 seconds to put the order together and mash the sell button, in that time it dropped to $506. So a profit of $32 p/share. Rare that you can get lucky and time it right, I slept good

So today it opened at $5560 or so and the ETF about $508 but it was already dropping from overnight contracts. I didnt buy back in, just didnt feel right.. At about 10am it dumped hard along with Silver. Like down to $5190 or so, heading towards a $400 drop in 30 minutes.

Both (Gold and Silver) selloffs today had to have been coordinated. Many guesses as to who but likely a big bank. Someone big is still short a lot in gold/silver.

The relentless buying today like other recent dips mostly filled the gap back to about $5470 ish

This has been going on with Silver regularly since December. Any big moves, it gets away from them, and they short it and dump it to get temporary control of the price. But buying volume just eats it right back up. Never seen anything like it

To your price spread question:

I dont think the spread was manipulated, just a timing thing catching up. Mostly a paper gold vs physical gold temporary difference and time zones.

Dollar is getting hammered down. Gold sees that, its the canary in the coal mine.. But Trump and Bessent have made it clear in recent days they don;t mind a weak dollar and are encouraging it. It

I'm not smart enough to go deeper but I think there's a bigger game at play.

Last edited:

Majority of people Don't own their homes, the Banks do. A Mortgage is like a lease-to-buy except if you walk away from a lease-to-buy you lose any equity you have.

I guess my point is, when I hear the word Own, in my mind, there are not that many who actually own their homes, maybe mobile homes? But have you seen the prices for those these days? $100k

Most people consider their home value as a large part of their net worth. Equity in same is used for loans etc.

$100K for mobile homes? LOL I've looked at 2 recently over $200K, A buddy owns one he bought a few years ago for $289K over in Sarasota. Waterfront on lakes or saltwater jacks it up a bunch. Depends greatly on location and age much like regular homes. Florida has more than any other state by far I think.

Ssayer

BIT Beta Team

NOBODY owns their home. Need proof? Try not paying your property taxes for a few years...

tigerwillow1

Known around here

You have to be careful comparing gold prices at different country exchanges. Some of the quotes include the country's VAT.

So this is true, yet my wife said she knew of two elderly co-workers that have not paid property taxes since they retired. Not really sure how that works but they are doing it. Sounds like they are protected from seizure in TexasNOBODY owns their home. Need proof? Try not paying your property taxes for a few years...

^^^ This is an interesting read.

I remember my wife telling me one lady said, instead of my kids fighting over this property, I will let the state have it when I die. lol

You have to be careful comparing gold prices at different country exchanges. Some of the quotes include the country's VAT.

Europe and US both use COMEX spot as the "official" spot

The COMEX Gold price in Europe is generally aligned with the US price, as COMEX Gold Futures are the most widely traded gold derivatives globally. This means that when the price in the US is high, it often reflects in Europe, and vice versa. However, there can be slight variations due to market conditions and liquidity differences

I dont follow foreign markets other than a general barometer on how it might effect US trends

NOBODY owns their home. Need proof? Try not paying your property taxes for a few years...

Or you can think of it another way... you own your home and the property taxes are to maintain infrastructure around your home... things like keeping out the natives... I'm sure you can imagine all sorts of other uses for property taxes.