Money & Economics

- Thread starter bigredfish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Ssayer

BIT Beta Team

If you aren't over the standard deduction, there is no change.

tigerwillow1

Known around here

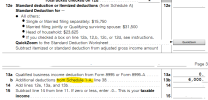

We must be having a communication problem. The 6k/12k extra senior deduction stacks on top of the standard deduction.If you aren't over the standard deduction, there is no change.

alastairstevenson

Staff member

It looks like you've been on the sauce again.

Cool it please, or figure out who has got your phone or tablet.

Cool it please, or figure out who has got your phone or tablet.

We must be having a communication problem. The 6k/12k extra senior deduction stacks on top of the standard deduction.

Right.

But if your income is taxed not SS and already under the standard, you pay no tax anyway right? So adding a deduction on top makes no difference?

tigerwillow1

Known around here

It depends on the individual situation. Somebody who has no tax without the deduction gets no benefit from it. In my case, for tax year 2025 we get the full 12k reduction of our taxable income, lowering the tax. This deduction has absolutely nothing to do with social security.But if your income is taxed not SS and already under the standard, you pay no tax anyway right? So adding a deduction on top makes no difference?

It depends on the individual situation. Somebody who has no tax without the deduction gets no benefit from it. In my case, for tax year 2025 we get the full 12k reduction of our taxable income, lowering the tax. This deduction has absolutely nothing to do with social security.

Yes quite aware. Its an add to the Std deduction

I think his point was he owes nothing without the extra deduction so it makes no difference. Many living on just SS will see the same $0 difference

The added $6000 deduction will save me approx $700

Last edited:

Well we know they don't like us, since we are seeing places charge 3% more to use credit cards, we are paying for things in cash more now so they really don't like us now...